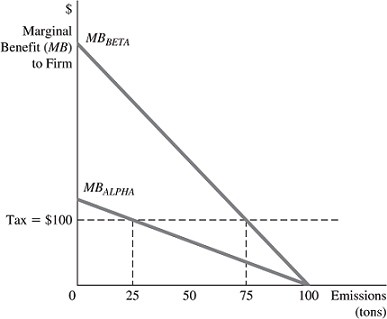

Refer to the information in Figure 16.5 below to answer the question(s) that follow. ?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. Before any tax on pollution is imposed, the total amount of pollution being emitted in this industry is ________ tons.

?Figure 16.5Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.Refer to Figure 16.5. Before any tax on pollution is imposed, the total amount of pollution being emitted in this industry is ________ tons.

A. 50

B. 100

C. 150

D. 200

Answer: D

You might also like to view...

Keynes was concerned about an implication of his consumption theory: that as an economy becomes more prosperous, its saving rate becomes too ________ to sustain that prosperity. Such a long-term trend in the U.S

saving rate is ________ in the time-series data. A) large, found B) large, not found C) small, found D) small, not found

Suppose a production possibilities frontier (PPF) has been plotted on a graph. If the horizontal axis of the graph measures the output of capital goods and the vertical axis measures the output of consumer goods, then a point outside the PPF represents: a. a smaller quantity of consumer goods than that represented by a point inside the PPF. b. an inefficient output combination of the two goods

in the economy. c. an unattainable output combination of the two goods in the economy. d. an output combination of more consumer goods than capital goods. e. a smaller quantity of capital goods than that represented by a point inside the PPF.

When the government levies a $100 million tax on people's income and puts the $100 million back into the economy in the form of a spending program, such as new interstate highway construction, the:

A. tax, then, generates a $100 million decline in real GDP. B. level of real GDP expands by $100 million. C. effect on real GDP is uncertain. D. tax multiplier overpowers the income multiplier, triggering a rollback in real GDP.

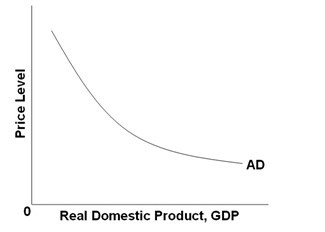

Refer to the graph below. Which of the following factors does not explain a movement along the AD curve?

A. The expenditure multiplier effect

B. The real-balances effect

C. The interest-rate effect

D. The foreign purchases effect