What is the amount of interest expense (in Canadian Dollars) recorded for 2016?

XYZ Corp. has a calendar year end. On January 1, 2016, the company borrowed $5,000,000 U.S. dollars from an American Bank. The loan is to be repaid on December 31, 2019 and requires interest at 5% to be paid every December 31. The loan and applicable interest are both to be repaid in U.S. dollars. XYZ does not hedge to minimize its foreign exchange risk.

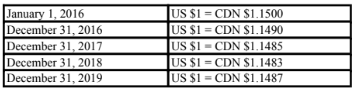

The following exchange rates were in effect throughout the term of the loan:

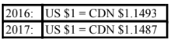

The average rates in effect for 2016 and 2017 were as follows:

A) $287,325. B) $372,500. C) $287,250. D) $250,000.

A) $287,325.

You might also like to view...

According to BizRateResearch, the most effective financial incentive is:

A) price discounts B) contests and sweepstakes C) free gifts D) free shipping

The following are examples of data mining, except:

A) American Eagle studying how consumers respond to price markdowns B) Goody's analyzing baskets of merchandise purchased by individual consumers C) Target identifying what other retail stores customers use for particular products D) First Horizon Bank expanding its wealth management business by studying profiles of its best customers

In preparing a company's statement of cash flows using the indirect method, the following information is available: Net income$60,000?Accounts payable decreased by 22,000?Accounts receivable increased by 29,000?Inventories increased by 9000?Depreciation expense 38,000?Net cash provided by operating activities was:

A. $100,000. B. $64,000. C. $60,000. D. $38,000. E. $82,000.

In most cases, the same sales strategy is used to sell a new and emerging product as a mature, well-established product

Indicate whether the statement is true or false