A pension fund manager who plans on purchasing bonds in the future:

A. will take the long position in a futures contract.

B. wants to insure against the price of bonds falling.

C. will take the short position in a futures contract.

D. can offset the risk of bond prices rising by selling a futures contract.

Answer: A

You might also like to view...

The formal and informal rules governing the organization of a society on the whole, including its laws and regulations, are referred to as:

A) organizational structure. B) religious norms. C) cultural scenario. D) institutions.

If the final expressions in a present value equation used to calculate the price of a bond you are considering buying are "[$75 / (1 + .04)6] + [$2,500 / (1 + .04)6]", which of the following is correct?

A) The face value is $75, the interest rate you need is 1.04 percent, and the coupon will mature in 6 years. B) The face value is $2,500, the coupon is $75, and the coupon will mature in 4 years. C) The face value is $2,500, the interest rate you need is 6 percent, and the coupon will mature in 4 years. D) The coupon is $75, the interest rate you need is 4 percent, and the coupon will mature in 6 years.

Which of the following efficiency wage models centers on the morale of a firm's workers? The

a. shirking model. b. gift exchange model. c. turnover model. d. None of the above

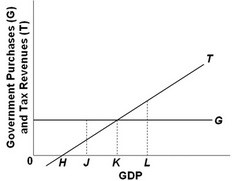

Refer to the above graph. Automatic stability in this economy could be decreased by:

Refer to the above graph. Automatic stability in this economy could be decreased by:

A. shifting the government expenditure line upward but parallel to its current position. B. changing the tax system so that the tax line has a flatter slope. C. changing the tax system so that the tax line is shifted upward but parallel to its present position. D. changing the government expenditures line so that it has a negative slope.