Assume that foreign capital flows from a nation increase due to political uncertainly and increased risk. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to the GDP Price Index and monetary base in the context of the Three-Sector-Model?

a. The GDP Price Index rises and monetary base rises

b. The GDP Price Index rises and monetary base falls.

c. The GDP Price Index and monetary base fall.

d. The GDP Price Index and monetary base remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.C

You might also like to view...

The practice of "monetizing the debt" is traditionally feared because it is thought to cause

A) unemployment. B) inflation. C) a falling price level. D) a liquidity trap.

All of the following are examples of physical capital EXCEPT

A) buildings. B) machinery. C) company stocks and bonds. D) a hydroelectric power plant.

Other things constant, the quantity of money demanded varies directly with the market interest rate

Indicate whether the statement is true or false

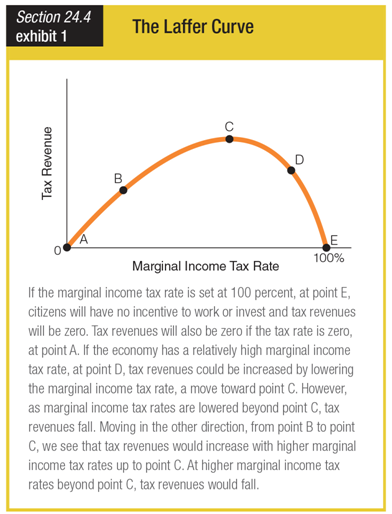

On the graph showing the Laffer curve, tax revenues are lowest at ______.

a. point B

b. point C

c. points B and D

d. points A and E