John is able to take out a loan for $1,000 for one year at an annual interest rate of 10 percent. After calculating his return to be $200, John will:

A. make money on net, and should take out the loan.

B. not make money on net, and should not take out the loan.

C. not make money on net, and should take out the loan.

D. make money on net, and should not take out the loan.

Answer: A

You might also like to view...

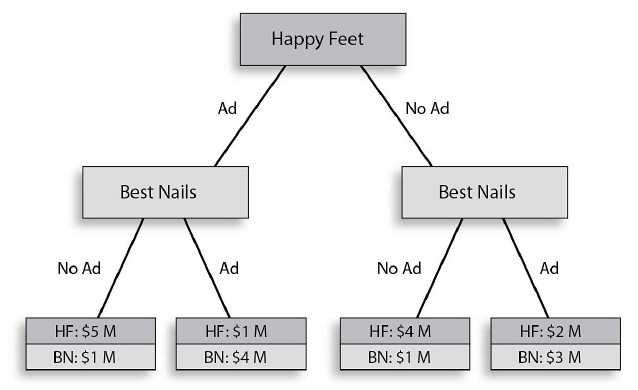

If Happy Feet chooses to No Ad, Best Nails should ________ and earn ________ million in net profit.

Happy Feet wants to prevent Best Nails from entering the nail salon market. The above game tree illustrates the different strategies and corresponding payoffs for the two firms. Both Happy Feet and Best Nails have the same strategies of advertising (Ad) or not advertising (No Ad). The payoffs represent net profit in millions.

A) Ad; $2 B) No Ad; $3 C) No Ad; $4 D) Ad; $3

Suppose that the U.S. can make 15 cars or 20 bottles of wine with one year's worth of labor. France can make 10 cars or 18 bottles of wine with one year's worth of labor. From these numbers, we can conclude

A. the U.S. has a comparative advantage in the production of cars. B. France has a comparative advantage in the production of wine. C. the U.S. has a absolute advantage in the production of wine. D. all of the above are conclusions are correct.

An economy that trades with the rest of the world is a(n) ________.

A. trade economy B. closed economy C. open economy D. command economy

The market structure in which the behavior of any given firm depends on the behavior of the other firms in the industry is

A. perfect competition. B. monopolistic competition. C. monopoly. D. oligopoly.