Assume that an assembly line has three tasks that must be completed (in order, A, B, and C). The tasks have processing times of 12, 15, and 10 minutes per unit, respectively. If the assembly line operates for 480 minutes per day with a desired output of 50 units per day, what is the takt time?

a. 0.1 units per minute

b. 13 units per minute

c. 9.6 units per minute

d. Cannot be determined from the information given

c. 9.6 units per minute

You might also like to view...

Intraperiod tax allocation

A) is used to allocate a company's total income tax expense to the components of net income and comprehensive income. B) involves temporary (timing) differences between financial and taxable incomes. C) requires allocation of deferred taxes across accounting periods. D) results from differences between tax regulations and the principles followed to determine financial income.

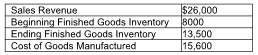

Compute cost of goods available for sale.

Fontana Manufacturing provided the following information for the month ended March 31:

A) $15,600

B) $29,100

C) $23,600

D) $10,100

The following information is available from Carron Company's 2014 accounting records: Purchases ............................................ $530,000 Purchase discounts ................................... 10,000 Beginning inventory .................................. 160,000 Ending inventory ..................................... 215,000 Freight-out .......................................... 40,000

Carron's 2014 cost of goods sold is a. $465,000. b. $475,000. c. $505,000. d. $585,000.

A company with 100,000 authorized shares of $4 par common stock issued 40,000 shares at $8. Subsequently, the company declared a 4% stock dividend on a date when the market price was $12 a share. What is the amount transferred from the Retained Earnings account to Paid-in Capital accounts as a result of the stock dividend?

A) $12,800 B) $19,200 C) $32,000 D) $48,800