Suppose there are ten firms that occupy the Odell, Oregon cherry pie market. The market share of each firm is listed in the above table

a) What is the four-firm concentration ratio in this market?

b) What is the Herfindahl-Hirschman Index for this market?

c) If Firm H and Firm A merge, what is the new Herfindahl-Hirschman Index for this market?

d) A severe winter causes every firm except A, B, and E to close. With only these three firms operating, Firm A's market share is 71 percent, Firm B's market share is 23 percent, and Firm C's market share is 6 percent. What is the Herfindahl-Hirschman Index for this market now?

a) The four-firm concentration rate is 74 percent.

b) The Herfindahl-Hirschman Index is 1,782.

c) Once firms H and A merge, the new Herfindahl-Hirschman Index is 2,038.

d) The Herfindahl-Hirschman Index is now 5,606.

You might also like to view...

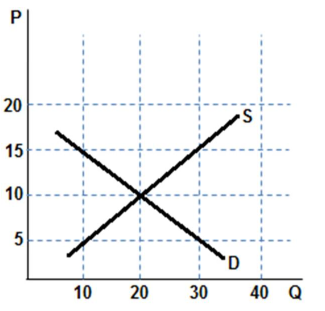

According to the graph shown, at a price of $5, there is a:

A. shortage of 10.

B. shortage of 20.

C. shortage of 30.

D. surplus of 20.

Money's basic advantage as compared to barter is that

A) everybody has money but not everyone has the opportunity to barter. B) a money system relies on a double coincidence of wants. C) money reduces transaction costs. D) money is the only medium you can use to store your wealth.

The existence of negative externalities:

A. causes the market to work more effectively. B. prevents the market from working efficiently. C. necessarily means that government must intervene in the marketplace. D. prevents government from intervening in the marketplace.

A contestable market is

A. An imperfectly competitive situation that is subject to entry. B. An imperfectly competitive situation with high barriers to entry. C. A market with only one producer. D. A perfectly competitive market.