When prices are falling, economists say that there is

a. disinflation.

b. deflation.

c. a contraction.

d. an inverted inflation.

b

You might also like to view...

Suppose the demand curve for a good is given by the equation P = 200 - 1/2 Q and the supply curve is given by the equation P = 50 + 1/4 Q, where P represents the price of the good (measured in dollars per unit) and Q represents the quantity of the good (measured in units per week).

(i) Find the equilibrium price and quantity for this market. (ii) Suppose the government imposes a sales tax of $9 per unit on this good. Find the new formula for the demand curve, the new equilibrium quantity, the post-tax price received by suppliers, and the post-tax price paid by demanders. (iii) What fraction of the economic burden of this tax is borne by demanders and what fraction is borne by suppliers?

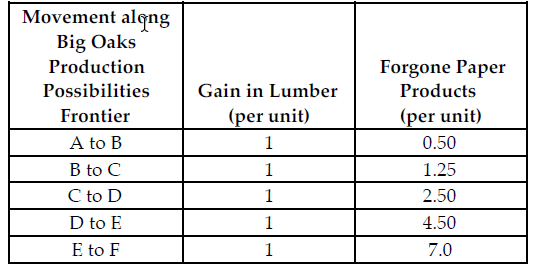

Refer to the table below. If the profit for each unit of paper product is $3.00 and the profit for each unit of lumber is $13.50, what is Big Oaks' marginal cost of producing between points B and C on their production possibilities frontier?

Big Oaks can produce either paper products or lumber with each tree that they harvest. Because Big Oaks can adjust the amount of paper products and lumber they produce from the harvested trees, paper products and lumber are produced in variable proportions. The above table summarizes Big Oaks production possibilities from each harvested tree.

A) $5.75

B) $3.75

C) $1.25

D) $7.50

Rents

A. have no useful economic purpose. B. have a distributional function since they affect incomes, but have no allocative function since the resource is in fixed supply. C. have an allocative function since they help decide to which use a resource will be put. D. have an economic purpose only if they are taxed and provide revenue to the government.

Answer the following statements true (T) or false (F)

1) When a company declares bankruptcy, stockholders are the first to be paid when company assets are sold. 2) Payments to holders of corporate bonds are known as dividends. 3) Index funds are an example of passively managed funds. 4) Actively managed funds consistently outperform index funds.