Prime Corporation liquidates its 85%-owned subsidiary Bass Corporation under the provisions of Secs. 332 and 337. Bass Corporation distributes land to its minority shareholder, John, who owns a 15% interest. The property received by John has a $55,000 FMV. The land was used in the Bass Corporation's business and has a $65,000 adjusted basis and is subject to a $10,000 liability, which is assumed

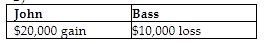

by John. John's basis in his stock is $25,000. What gain or loss will John and Bass Corporation recognize on the distribution of the land?

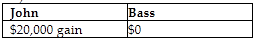

a.

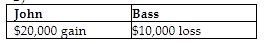

b.

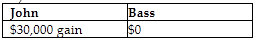

c.

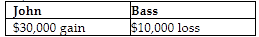

d.

b.

You might also like to view...

Which of the following is a "Big Five" personality trait?

A. cognitive ability B. extroversion C. aptitude D. physical ability E. honesty

Being able to handle multiple problems at the same time, having discipline to maintain personal filing systems, and adapting to change are all examples of ____ skills.

A. business B. soft C. time-management D. self-management

"You ought to buy that scarf. It is just like the one that I saw Julia Roberts wearing when she was dining at the Blue Goose Inn." This is an example of a(n):

A. direct suggestion. B. prestige suggestion. C. autosuggestion. D. suggestive proposition. E. counter suggestion.

Thomas Schatz has five questions to ask his reader in a routine information-request message. What is the best way to present these questions?

A) ?As a separate enclosure B) ?In a bulleted or numbered list in the body of his message C) ?In paragraph form in the body of his message D) ?In a follow-up e-mail