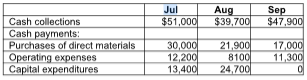

The cash balance on June 30 is projected to be $4500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 4%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the amount of principal repayment at the

Burchfield, Inc. has prepared its third quarter budget and provided the following data:

A) $5,000

B) $10,000

C) $15,000

D) $20,000

D) $20,000

You might also like to view...

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements. Given this information forecasts of future growth in inventory will most likely affect growth in

a. accounts receivables. b. accounts payable. c. depreciation. d. salary payable.

There are a number of offensive strategy options for improving market positions using cost-based and blue-ocean type strategies. Define the terms and suggest ways in which the strategies could be operationalized.

What will be an ideal response?

______ is a step in the strategic planning process.

a. Analyzing the environment b. Assessing the code of ethics c. Assessing the competition d. Creating conclusions concerning the competitive position

Jackson Company paid $500 cash for salary expenses. Which of the following accurately reflects how this event affects the company's accounting equation? Assets=Liab.+EquityA.500=500+NAB.(500)=NA+(500)C.(500)=(500)+NAD.(500)=NA+500

A. Option A B. Option B C. Option C D. Option D