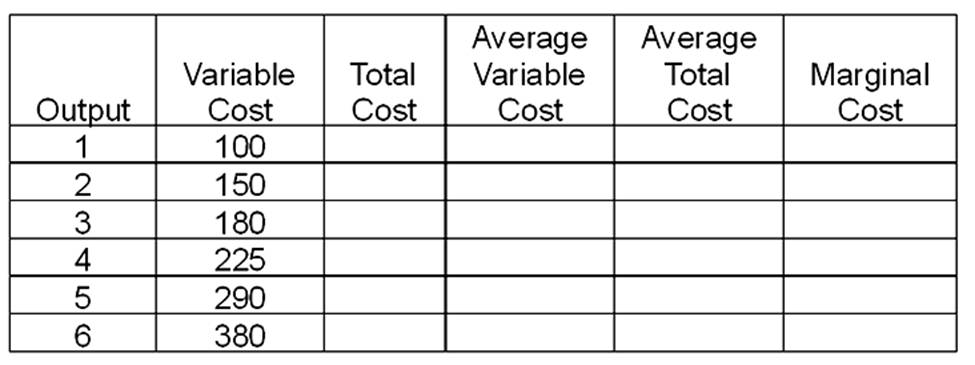

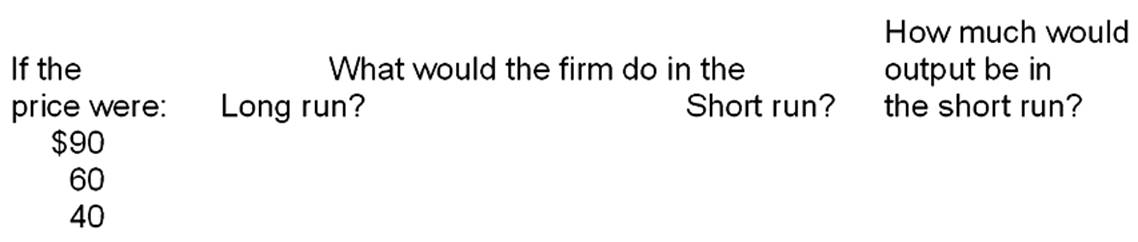

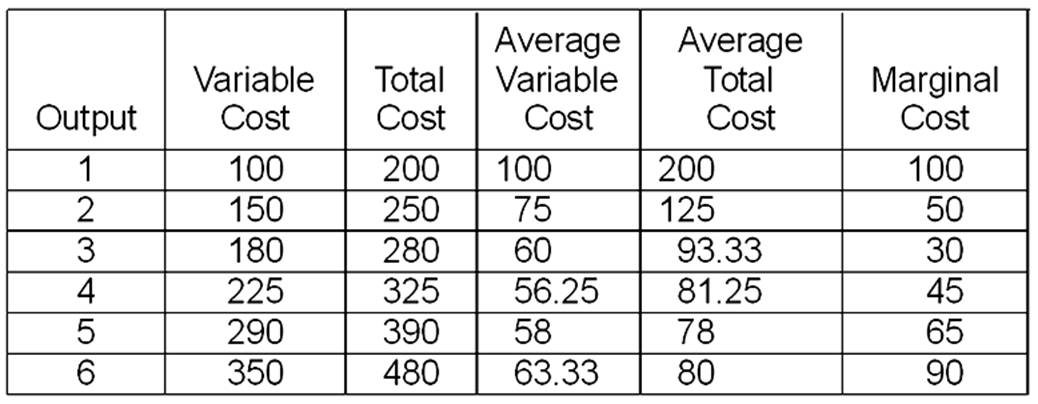

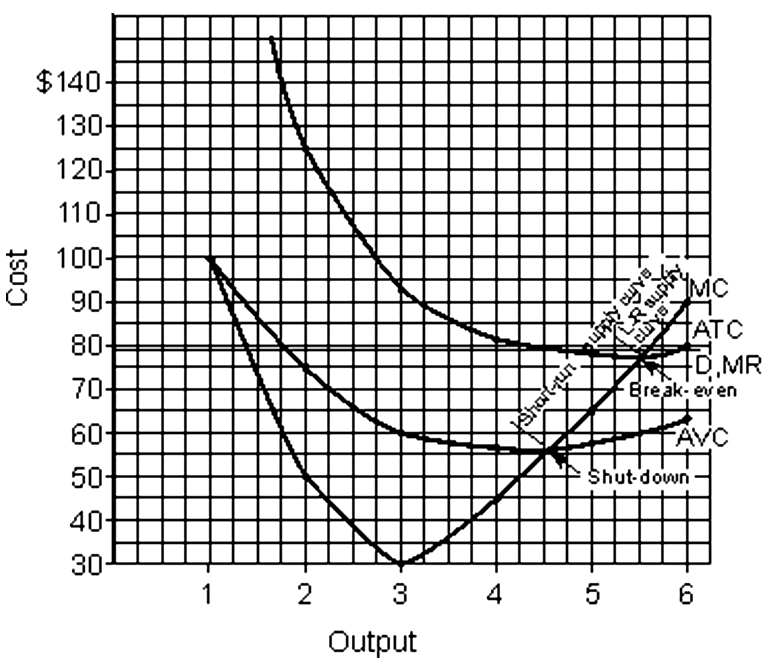

This problem should be done in four steps. First, fill in the table directly below. Assume that fixed cost is $100 and price is $79. Second, on the graph paper draw the graphs of the firm's demand, marginal revenue, average variable cost, average total cost, and marginal cost curves. Be sure you label the graph correctly. Indicate the firm's short-run and long-run supply curves, and the break-even and shutdown points. Third, calculate total profit in the space below and then answer questions A-D. Fourth, complete the second table.

A. The minimum price the firm would accept in the short run would be $___________.

B. The minimum price the firm would accept in the long run would be $___________.

C. The output at which the firm would operate most efficiently would be ___________.

D. The output at which the firm would maximize profits would be ___________.

Total Profit = (price - ATC) × output

= ($79 - $78) × 5.55

= $1 × 5.55

= $5.55

a. $56 (must be under $56.25)

b. $77.50 (must be under $78)

c. 5.5

d. 5.55

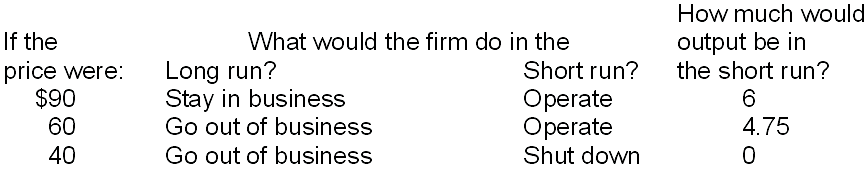

You might also like to view...

The new $20 bills were designed with features to make counterfeiting more difficult

a. True b. False Indicate whether the statement is true or false

In the open-economy macroeconomic model, if the supply of loanable funds shifts right, then

a. net capital outflow increases so the demand for dollars in the market for foreign-currency exchange shifts right. b. net capital outflow increases so the supply of dollars in the market for foreign-currency exchange shifts right. c. net capital outflow decreases so the demand for dollars in the market for foreign-currency exchange shifts left. d. net capital outflow decreases so the supply of dollars in the market for foreign-currency exchange shifts right.

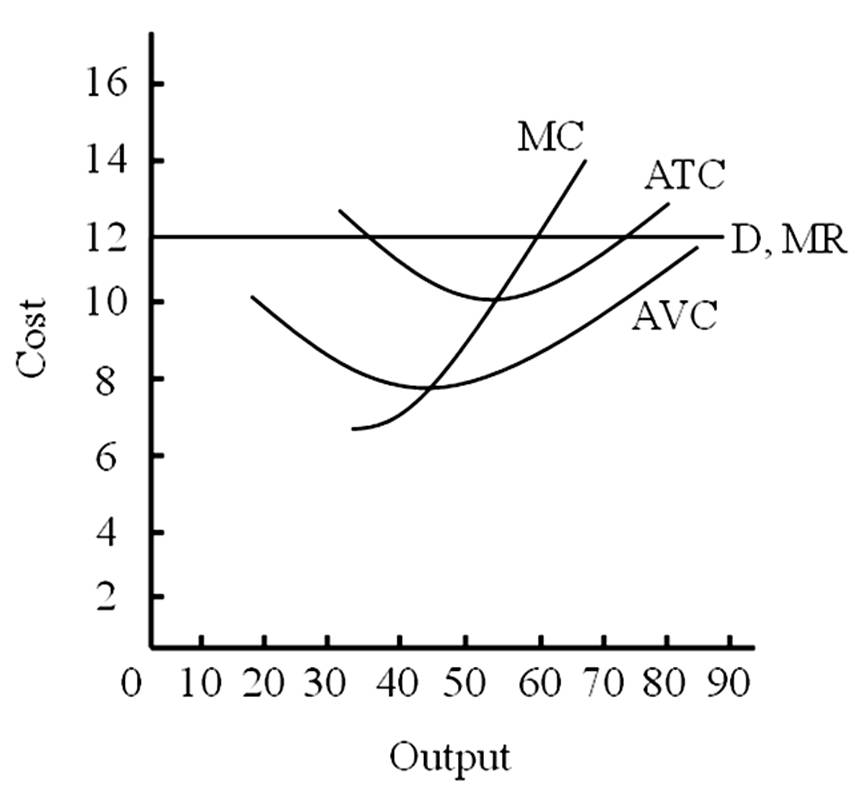

This firm's most profitable output is at

A. 40.

B. 50.

C. 60.

D. 70.

The FE curve has a

A. positive slope because a decrease in domestic interest rates leads to capital outflows causing a surplus in the official settlements balance. An increase in output levels is thus needed to reduce that surplus. B. negative slope because an increase in domestic interest rates leads to capital inflows causing a surplus in the official settlements balance. A decrease in output levels is thus needed to reduce that surplus. C. negative slope because an increase in domestic interest rates leads to capital outflows causing a deficit in the financial account balance. An increase in output levels is thus needed to reduce that deficit. D. positive slope because an increase in domestic interest rates leads to capital inflows causing a surplus in the financial account balance. An increase in output levels is thus needed to reduce that surplus.