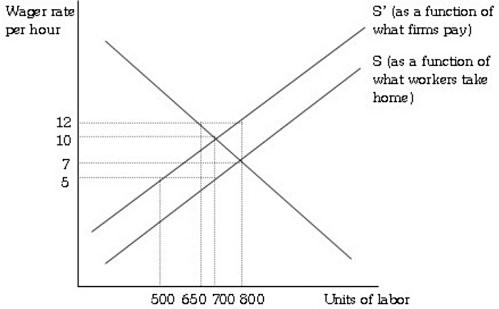

Refer to the information provided in Figure 19.1 below to answer the question(s) that follow.  Figure 19.1 Refer to Figure 19.1. The payroll tax imposed initially

Figure 19.1 Refer to Figure 19.1. The payroll tax imposed initially

A. reduced the equilibrium wage rate by $3 per hour.

B. did not change the equilibrium wage rate.

C. reduced the equilibrium wage rate by $5 per hour.

D. increased the equilibrium wage rate by $3 per hour.

Answer: B

You might also like to view...

Automatic payroll deductions help people to fight ____________________ .

Fill in the blank(s) with the appropriate word.

Which of the following statements is NOT true of external benefits?

A) External benefits lead to an underallocation of resources to the production of the good that has the external benefit. B) External benefits lead to a price in the market that is too high. C) External benefits lead to too few of the goods that have the external benefit being produced. D) External benefits are a good thing for the allocation of resources because people are getting something at no cost.

The marginal product of any input into the production process is the:

A. increase in output that is generated by an additional unit of input. B. decrease in input that is generated by an additional unit of output. C. constant ratio of inputs to outputs. D. ratio total output divided by total quantity.

In 2014, what percent of the population lived under the official poverty line in the United States?

A. 11.3 percent, down from a near all-time high of 25 percent in 2000. B. 14.8 percent, higher than a near all-time low of 3.11 percent in 2000. C. 11.3 percent, down from a near all-time high of 14.8 percent in 2000. D. 14.8 percent, higher than a near all-time low of 11.3 percent in 2000.