Historically, the government has used fiscal policy to affect the economy through

a. central planning.

b. indicative planning.

c. aggregate demand.

d. aggregate supply.

c

You might also like to view...

When the economy is operating at an unemployment rate below the full employment rate,

a. actual output is above potential output b. actual output equals potential output c. actual output is below potential output d. frictional unemployment has been eliminated e. structural unemployment has been eliminated

Give an example of a tax system where the marginal tax rate would equal the average tax rate

Barter is the:

A. direct exchange of goods and services. B. exchange of goods, but not services. C. system that does not depend on a coincidence of wants. D. system used in advanced economies.

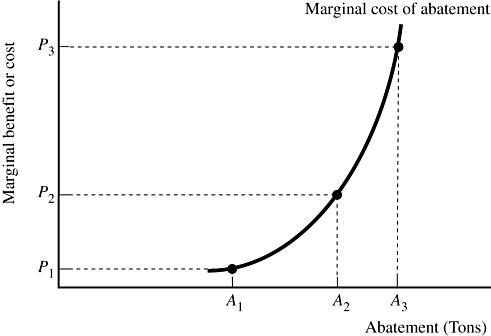

A firm that generates pollution is illustrated in Figure 9.7. If the government imposes a pollution tax equal to P2 and the firm chooses abatement level A3:

A firm that generates pollution is illustrated in Figure 9.7. If the government imposes a pollution tax equal to P2 and the firm chooses abatement level A3:

A. the marginal cost of abating is greater than the marginal benefit of abating. B. the marginal benefit of abating is greater than the marginal cost of abating. C. the firm is choosing optimally. D. the firm is in violation of environmental protection laws.