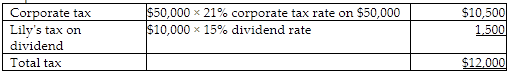

Artco Inc. is a C corporation. This year it earned $50,000 of taxable income and paid a $10,000 distribution (dividend) to Lily, its sole shareholder. Lily has a marginal tax rate of 24%. Due to the corporation's results and the distribution paid, the IRS will receive total taxes of

A) $12,000.

B) $12,900.

C) $13,500.

D) $10,500.

A) $12,000.

You might also like to view...

The best way to maximize the value of a positive first impression is to reinforce it with favorable experiences throughout the course of future interactions.

Answer the following statement true (T) or false (F)

University-based groups providing individual counseling and practical training to owners of small businesses are known as

A. the Small Business Administration. B. small-business development centers. C. small-business institutes. D. special task forces. E. none of these answer choices.

Tavis Robotics Corporation has developed a new robot-model FI-73-that has been designed to outperform a competitor's best-selling robot. The competitor's product has a useful life of 10,000 hours of service, has operating costs that average $4.60 per hour, and sells for $109,000. In contrast, model FI-73 has a useful life of 30,000 hours of service and its operating cost is $2.60 per hour. Tavis has not yet established a selling price for model FI-73.From a value-based pricing standpoint, what is the differentiation value offered by FI-73 relative to the competitor's offering for each 30,000 hours of service?

A. $278,000 B. $155,000 C. $60,000 D. $187,000

A problem that deals with the direct distribution of products from supply locations to demand locations is called a(n):

a. transportation problem b. assignment problem c. network problem d. transshipment problem