You have a bond that pays $60 per year in coupon payments. Which of the following would result in a decrease in the price of your bond?

A) Coupon payments on newly-issued bonds rise to $75 per year.

B) The likelihood that the firm issuing your bond will default on debt decreases.

C) Coupon payments on newly-issued bonds fall to $40 per year.

D) The price of a share of stock in the company rises.

A

You might also like to view...

In the short run, if the Fed wants to raise the federal funds rate, it

A) instructs large commercial banks to sell government securities in the open market. B) instructs the New York Fed to buy government securities in the open market. C) instructs the New York Fed to sell government securities in the foreign exchange market. D) instructs the New York Fed to sell government securities in the open market. E) tells large commercial banks to raise their interest rates.

Which of the following is not an example of a commonly tax-funded program?

A. Public education. B. Highways. C. Housing to those in need. D. Oil and gas production.

If individuals become so discouraged that they stop seeking jobs, then the:

a. Unemployment rate rises and the employment rate falls. b. Unemployment rate falls and employment rate stays the same. c. Unemployment rate falls and the employment rate falls. d. Unemployment rate remains the same and the employment rate stays the same. e. Unemployment rate falls, and the employment rate rises.

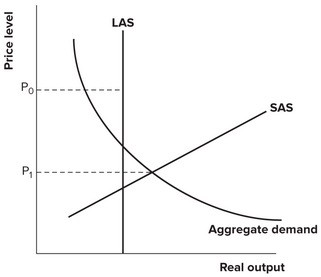

Refer to the graph shown. If the price level is P0, then:

A. both input prices and output will fall in the long run. B. both input prices and output will rise in the long run. C. input prices will fall and output will rise in the long run. D. input prices will rise and output will fall in the long run.