Assume that the yen price of one U.S. dollar rises to 80 yen and that the Bank of Japan has a target exchange rate of 75 yen per dollar. As a result, the Bank of Japan will intervene in the foreign exchange market by:

a. selling U.S. dollars and buying yen.

b. selling both U.S. dollars and yen.

c. buying U.S. dollars and selling yen.

d. buying both U.S. dollars and yen.

e. buying U.S. Treasury securities.

a

You might also like to view...

If the multiplier = 2.5, the MPS would be

A) 0.25. B) 0.4. C) 0.6. D) 0.75.

Which of the following conditions would result in the short run marginal cost curve not correctly reflecting the supply behavior of a profit maximizing firm?

a. The firm is a price taker. b. Price exceeds average total cost. c. The elasticity of demand facing the firm is ?3. d. the firm can vary several inputs in the short run.

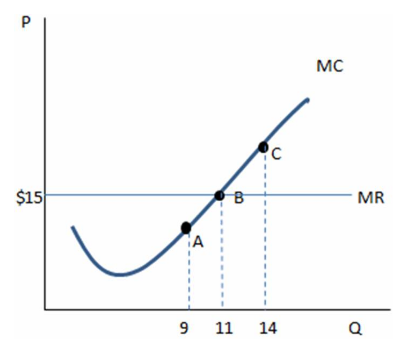

According to the graph shown, producing 9 units earns profits that are:

A. lower than output of 11 units, and the firm should increase production.

B. higher than output of 11 units, and the firm should decrease production.

C. higher than output of 11 units, and the firm should increase production.

D. lower than output of 11 units, and the firm should decrease production.

A horizontal demand curve is perfectly elastic because a change in price will induce an infinite change in quantity demanded

a. True b. False Indicate whether the statement is true or false