What is an advantage of using options instead of forward contracts when hedging against exchange-rate risk?

What will be an ideal response?

Options contracts have the advantage to hedgers that if the price moves in the opposite direction to the one being hedged against, the hedger can decline to exercise the option and instead can gain from the favorable price movement.

You might also like to view...

The "law of demand" indicates that if the University of Maine increases tuition, all other things remaining the same,

A) the demand for classes will decrease at the University of Maine. B) the demand for classes will increase at the University of Maine. C) the quantity of classes demanded will increase at the University of Maine. D) the quantity of classes demanded will decrease at the University of Maine. E) both the demand for and the quantity of classes demanded will decrease at the University of Maine.

A compensating differential is a difference in wages due to higher levels of education or other forms of human capital

a. True b. False Indicate whether the statement is true or false

An oligopoly between two firms is called

A) a biopoly. B) an oligopoly; there are no special terms used for oligopolies with different numbers of firms. C) a dual-firm oligopoly. D) a duopoly.

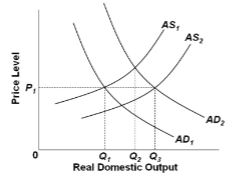

Refer to the diagram. If aggregate supply is AS 1 and aggregate demand is AD 0 , then:

A. at any price level above G a shortage of real output would occur.

B. F represents a price level that would result in a surplus of real output of AC.

C. a surplus of real output of GH would occur.

D. F represents a price level that would result in a shortage of real output of AC.