If the rate of inflation in a given time period turns out to be lower than lenders and borrowers anticipated, then the effect will be:

a. a redistribution of wealth from borrowers to lenders.

b. a redistribution of wealth from lenders to borrowers.

c. a net loss in purchasing power for lenders relative to borrowers.

d. a net gain in purchasing power for borrowers relative to lenders.

a

You might also like to view...

If the dollar rises against the euro, the dollar buys ________ euros, the euro ________ and the dollar ________

A) more; depreciates; appreciates B) more; appreciates; depreciates C) less; appreciates; depreciates D) more; depreciates; depreciates E) less, depreciates; appreciates

If the absolute price of a car is $20,000 and the relative price of a computer is 20 cars, it follows that the absolute price of a car is

a. $400. b. $4,000. c. $100. d. $1,000.

Figure 3-23

Refer to . It is apparent from the figure that

a.

the good is inferior.

b.

the demand for the good decreases as income increases.

c.

the demand for the good conforms to the law of demand.

d.

All of the above are correct.

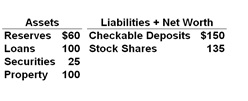

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:

Refer to the above data. If commercial bankers decide to hold additional excess reserves equal to 7 percent of any newly acquired deposits, then the relevant monetary multiplier for this banking system will be:

A. 8.33

B. 6.66

C. 5.26

D. 4.76