In making decisions about insurance, a crucial piece of information to know is:

A. how easily you can reduce the risk of experiencing the event you're insuring against.

B. how many others will likely be affected by the same risk.

C. how catastrophic would the event's occurrence be if the event you're insuring against happened.

D. when the event you're insuring against is most likely to occur.

C. how catastrophic would the event's occurrence be if the event you're insuring against happened.

You might also like to view...

New York Times writer Michael Lewis wrote that "The sad truth, for investors, seems to be that most of the benefits....are passed through to consumers free of charge." To which of the following did Lewis refer?

A) the Enron accounting scandal B) apple farming in New York state C) new technologies developed in the 1990s D) the medical screening industry

The law of supply implies that the supply curve is

A) flat. B) upward sloping. C) downward sloping. D) vertical.

The value of marginal product curve is downward sloping because:

A. profits decline as more workers are hired. B. firms must lower price to sell more. C. of the law of diminishing returns. D. at lower wages, only less qualified workers are available.

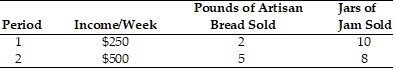

Use the above table. The income elasticity of jam is

Use the above table. The income elasticity of jam is

A. 0.33. B. -3.00. C. 3.00. D. -0.33.