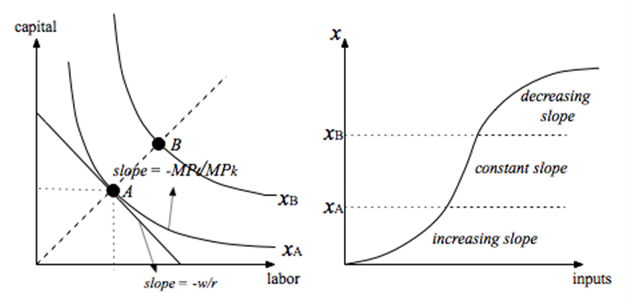

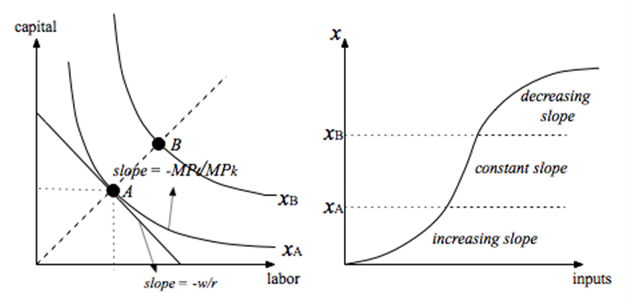

Consider a firm that uses labor and capital to produce output x using a homothetic production technology that has increasing returns to scale when output lies between 0 and xA, constant returns to scale when output lies between xA, and xB, and decreasing returns to scale when output exceeds xB (where 0

What will be an ideal response?

a. This is illustrated in the first panel below.

b. Input bundle B an the cost-minimizing ray are pictured above, and the vertical slice along this ray is pictured in the second panel above.

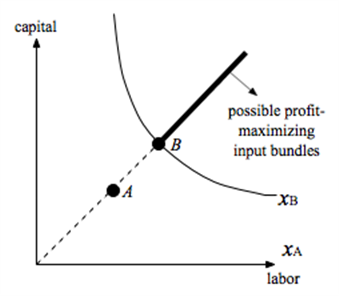

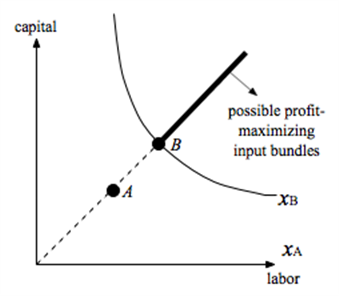

c. Only production plans on the decreasing returns to scale portion of the cost-minimizing ray of input bundles could be profit-maximizing. (See graph below.)

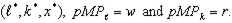

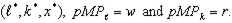

d. At

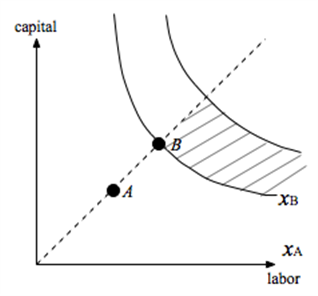

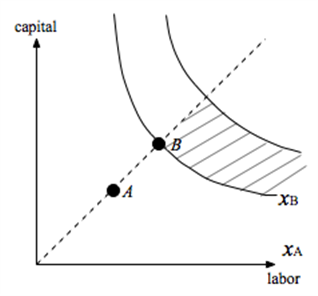

e. The set of input bundles that could contain the new profit maximizing bundle is the shaded area in the graph below. An increase in r causes substitution away from capital and toward labor -- implying that all cost-minimizing bundles lie to the right of the original ray. When input prices rise, the profit-maximizing output level falls -- implying the profit maximizing input bundle at the higher r lies below the isoquant for x*. BUT it still has to fall on the decreasing returns to scale portion of the frontier -- implying it must lie above the isoquant through B.

b. Input bundle B an the cost-minimizing ray are pictured above, and the vertical slice along this ray is pictured in the second panel above.

c. Only production plans on the decreasing returns to scale portion of the cost-minimizing ray of input bundles could be profit-maximizing. (See graph below.)

d. At

e. The set of input bundles that could contain the new profit maximizing bundle is the shaded area in the graph below. An increase in r causes substitution away from capital and toward labor -- implying that all cost-minimizing bundles lie to the right of the original ray. When input prices rise, the profit-maximizing output level falls -- implying the profit maximizing input bundle at the higher r lies below the isoquant for x*. BUT it still has to fall on the decreasing returns to scale portion of the frontier -- implying it must lie above the isoquant through B.

Economics

You might also like to view...

Explain the effect on the demand for dollars in the foreign exchange market of an increase in the U.S. interest rate differential

What will be an ideal response?

Economics

What do we mean by efficient production?

What will be an ideal response?

Economics

Toyota's just-in-time system is an example of

A) backward (upstream) integration. B) quasi-vertical integration. C) using transfer pricing to avoid price controls. D) horizontal, downstream integration.

Economics

Why do firms engage in price discrimination?

A) to decrease cost B) to increase profits C) to increase consumer surplus D) to prohibit the resale of their products

Economics