When the government imposes taxes on buyers or sellers of a good, society

a. loses some of the benefits of market efficiency.

b. gains efficiency but loses equality.

c. is better off because the government's tax revenues exceed the deadweight loss.

d. moves from an elastic supply curve to an inelastic supply curve.

a

You might also like to view...

During the 1960s, 1970s, and early 1980s, traditional bank profitability declined because of

A) financial innovation that increased competition from new financial institutions. B) a decrease in interest rates to fight the inflation problem. C) a decrease in deposit insurance. D) increased regulation that prohibited banks from making risky real estate loans.

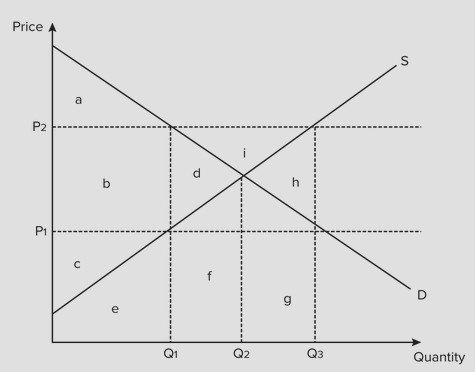

Use the figure below to answer the following question. If a price ceiling in this market is set at P1, then producer surplus equals area

If a price ceiling in this market is set at P1, then producer surplus equals area

A. c. B. b + c. C. b. D. c + b + d.

Which of these examples is an example of price discrimination?

A. Seniors pay one price at the movie theater and adults pay more. B. Cereal manufacturers put discount coupons inside their cereal boxes. C. Wholesale prices differ from retail prices. D. Goods are marked down on sale.

Which of the following is NOT a cause for an oligopoly to exist?

A) economies of scale B) structural dependence C) barriers to entry D) horizontal mergers