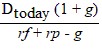

Suppose there is a reduction of the return provided on U.S. Treasury bonds. We should expect the current price of stocks to:Ptoday =

A. increase since the risk premium on the stocks will increase.

B. stay the same; there is no effect on stock prices from this reduction.

C. decrease since U.S. Treasury bonds are safer.

D. increase since the risk-free return is now lower.

Answer: D

You might also like to view...

If Deluxe Fruits offers a $1.00 coupon for their fruit cups, this is an example of ________.

A) second-degree price discrimination B) first-degree price discrimination C) arbitrage D) market segmentation

A country runs a deficit in its current account if:

a. ?it follows the double-entry bookkeeping requirement that total debits must equal total credits. b. ?foreign currency received from exports and transfers exceeds the foreign exchange needed to pay for imports and to make unilateral transfers. c. ?it consumes less goods and services compared to what it produces. d. ?foreign currency received from exports and transfers is less than the foreign exchange needed to pay for imports and to make unilateral transfers. e. ?the interest and dividends earned by its residents on foreign assets exceed the interest and dividends earned by foreigners who invest in domestic assets.

Because unregulated natural monopolies earn economic profits greater than zero in the long run, but cannot attract new entrants into the industry:

A. government agencies often regulate the number of firms that compete against natural monopolies. B. government agencies often regulate the price natural monopolies can charge. C. natural monopolies often go out of business. D. natural monopolies are outlawed.

Explain how a consumer maximizes utility

What will be an ideal response?