Refer to Scenario 10.3. Suppose that a tax of $5 per unit of output is imposed on red herring producers. The price of red herring will

A) not change.

B) increase by less than $5.

C) increase by $5.

D) increase by more than $5.

E) decrease.

B

You might also like to view...

The M1 money supply is composed of currency, checkable deposits, and time deposits.

Answer the following statement true (T) or false (F)

You are provided with the following information about a country's international transactions during a given year (in millions):Service exports$346Service imports$354Merchandise exports$480Merchandise imports$348Income flows, net$153Gifts to foreigners$142Increase in the country's holding of foreign assets, net (excluding official reserves assets)$352Increase in foreign holdings of the country's assets, net (excluding official reserves assets)$252Statistical discrepancy, net credit$154 Calculate the official settlements balance and the current account balance. Is the country increasing or decreasing its net holdings of official reserve assets? By how much?

What will be an ideal response?

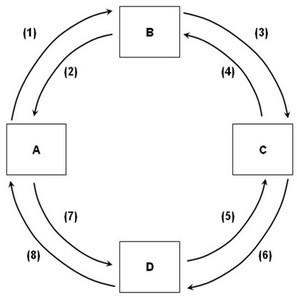

Refer to the above figure. If box A represents businesses and flow (7) represents goods and services, then:

Refer to the above figure. If box A represents businesses and flow (7) represents goods and services, then:

A. box C is the product market and box B is the resource market. B. box D is the product market and box B is households. C. box D is the product market and box B is the resource market. D. box B is the product market and box C is households.

Which of the following integration types aims at reducing transaction costs?

A. Cointegration B. Vertical integration C. Conglomerate integration D. Horizontal integration