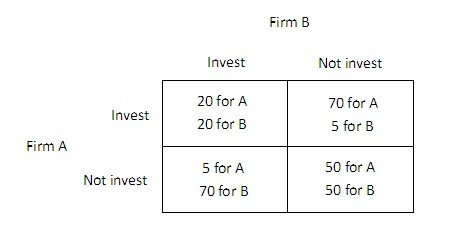

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

An industry spy comes to firm B and claims to know what firm A has decided. Given that each firm already knows the payoff matrix, how much would this information be worth to firm B?

A. $0.

B. $50 million.

C. $70 million.

D. $30 million.

Answer: A

You might also like to view...

What are the two largest expenditure categories in the EU budget?

What will be an ideal response?

Suppose consumers anticipate that their wealth will grow over time, because of interest earnings and capital gains. According to the life-cycle hypothesis, such optimism should cause current consumption to be ________

A) relatively low B) relatively insensitive to changes in income C) rising as individuals near retirement age D) relatively high

The Equal Employment Opportunity Commission

a. was established by the Equal Rights Act of 1984 b. examines cases in which a worker is not paid the same as other workers performing the same work c. guarantees a worker's right to a job d. established a minimum wage for minorities e. has effectively eliminated racial discrimination in the workplace

In the monetary equation of exchange, MV = PQ, P stands for

a. total price. b. average price. c. purchases. d. the Producer Price Index.