The demand curve for pizza in Foodieland is vertical. If a tax is imposed on each pizza bought, ________

A) the burden of the tax will fall entirely on the buyers

B) the burden of the tax will fall entirely on the sellers

C) the tax incidence on the sellers will be higher than that on the buyers

D) the deadweight loss due to taxation will be large

A

You might also like to view...

Lowering the discount rate has the effect of ________.

A. forcing commercial banks to call in outstanding loans from their best customers B. turning required reserves into excess reserves C. turning excess reserves into required reserves D. making it less expensive for commercial banks to borrow from central banks

According to the text, during which time period did the United States have the highest unemployment rates?

A) 1930s B) 2000s C) 1950s D) 1980s

Given the consumption equation C = $500 billion + 0.80Y, an increase in national income from $6,000 billion to $7,000 billion will cause consumption to increase by

a. $800 billion b. $1,000 billion c. $1,300 billion d. $1,500 billion e. $1,800 billion

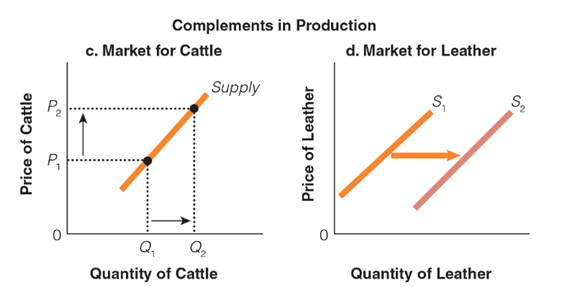

In Graph C, if P1 moved to P2 which of the following would most likely happen?

a. The price of leather would decrease.

b. The price of leather would decrease, but the quantity of leather would increase.

c. The price of leather would increase, but the quantity of leather would decrease.

d. The quantity of leather would increase.