Why don't we divide the economic pie evenly so that each person receives the same income?

This question addresses the role of incentives. If people generally prefer leisure to work, not many will be willing, without reward, to engage in productive activities. Thus, if the link between work effort and reward is weakened, individuals have less incentive to work effectively to create income.

You might also like to view...

The demand for insulin is quite inelastic. The demand for Pepsi is quite elastic. Suppose the elasticity of supply for insulin is the same as the elasticity of supply for Pepsi

If a $0.20 tax was imposed on each of these goods (holding everything else constant), which consumers would pay more of the tax? A) the Pepsi consumers B) the insulin consumers C) There would be no difference in the amount of tax paid by the consumers. D) More information is needed to determine which consumers pay more of the tax. E) The premise of the question is wrong because the elasticity of demand and the incidence of a tax are not related.

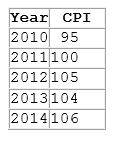

According to the table shown, which year is most likely being used for the base year?

A. 2010

B. 2011

C. 2012

D. 2013

Nontariff barriers lead to: a. decreases in the prices of imports

b. an increase in domestic production. c. increases in the prices of exports. d. an increase in domestic consumption.

Which of the following is true?

a. The production possibilities curve indicates that it will be impossible to expand total output with the passage of time. b. As long as resources are scarce, output cannot be increased. c. The size of the economic pie is fixed, and therefore, if one individual has more income, others must have less. d. Over time, the output of goods and services can be increased through human ingenuity and discovery of better ways of doing things.