The free rider problem suggests that a producer will tend to: i. produce more than the optimal quantity of a public good. ii. produce less than the optimal quantity of a public good. iii. produce the optimal quantity of a public good if it is funded out of tax revenue

a. (i) only

b. (ii) only

c. (i) and (iii) only

d. (ii) and (iii) only

d

You might also like to view...

Starting from long-run equilibrium, a large tax cut will result in a(n) ________ gap in the short-run and ________ inflation and ________ output in the long-run.

A. expansionary; higher; higher B. expansionary; higher; potential C. recessionary; higher; potential D. recessionary; lower; lower

Children of female heads of households are five times more likely to live in poverty than other children

a. True b. False

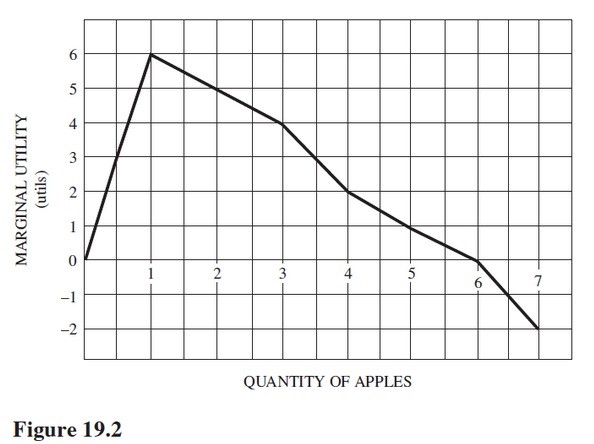

Refer to Figure 19.2. The total utility of five apples is

A. 20 utils. B. 1 utils. C. 17 utils. D. 18 utils.

Which of the following describes a situation in which the person is hurt by inflation?

A) a retiree whose pension is adjusted for inflation B) a person who borrows money during a period when inflation is under-predicted C) a person who lends money during a period when inflation is over-predicted D) a person paid a fixed income during an inflationary period