Suppose the economy was in equilibrium, and the national government increased spending by $200 billion. Monetarist theory would predict that the nation's:

a. Real risk-free interest rate will remain unchanged, but the money multiplier will rise.

b. Real risk-free interest rate will fall causing real GDP to rise.

c. Real risk-free interest rate will fall causing the money multiplier to rise.

d. Real risk-free interest rate will rise but real GDP will remain the same.

e. Real risk-free interest rate will rise causing real GDP to fall.

.D

You might also like to view...

An example of a Pigovian tax would be a tax on:

A. income. B. cigarettes. C. corporate capital gains. D. All of these are examples.

Augi sells 300 cat toys each month when the price is $5 per toy. When Augi lowered the price to $4, she sold 400 toys. The price elasticity of demand over the $4 to $5 range is approximately:

A. 0.78 and inelastic. B. 1.29 and inelastic. C. 1.29 and elastic. D. 0.78 and elastic.

According to the classical theory, an inward shift in aggregate demand would reduce

A. the price level but increase real Gross Domestic Product (GDP). B. real income but have no impact on the price Gross Domestic Product (GDP). C. real Gross Domestic Product (GDP) and the price level. D. the price level but have no effect on real Gross Domestic Product (GDP).

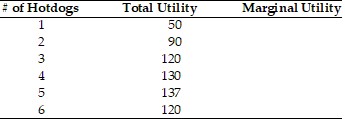

In the above table, what is the marginal utility of the second hotdog consumed?

In the above table, what is the marginal utility of the second hotdog consumed?

A. 40 B. 10 C. 30 D. 90