Diamonds are considered:

A. a renewable resource.

B. a nonrenewable resource.

C. physical capital.

D. technology.

B. a nonrenewable resource.

You might also like to view...

Assume that a 50 percent gasoline tax led to a large increase in its price and only a small decrease in the quantity of gasoline demanded. Economic analysis would lead one to conclude that

A) gasoline should not be taxed because the benefits are uncertain. B) the benefits of taxing gasoline is a normative issue. Economic analysis can be used to contribute to discussion of this issue but cannot decide it. C) gasoline should be taxed because the benefits of the tax would exceed the costs. D) gasoline should not be taxed on ethical grounds since ethical benefits and costs can't be measured.

You just bought a $1,000 bond that is scheduled to mature in ten years. If interest rates rise during the next six months, the market value (or price) of your bond will

a. increase. b. decrease. c. remain unchanged. d. increase or decrease, depending on the marginal tax bracket you are in.

Based on your sketch, is the good a normal or inferior good?

What will be an ideal response?

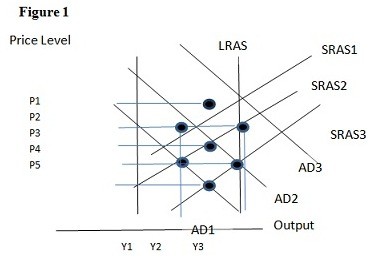

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the short run would be:

A. P3 and Y1. B. P2 and Y1. C. P2 and Y3. D. P1 and Y2.