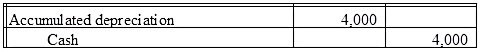

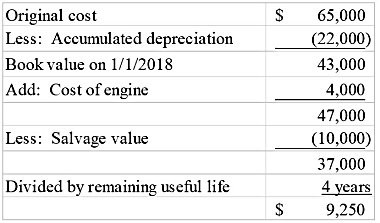

Mays Corporation purchased a new truck on January 1, Year 1 for $65,000 cash. The salvage value was estimated to be $10,000 at the end of the useful life of 5 years. On January 1, Year 3, Mays had to replace the engine of the truck paying $4,000 cash. At that time, Mays estimates that the truck will continue a productive life for another four years. The company uses the straight-line method. Required:a) Prepare the journal entry to record the cost of the new engine.b) Calculate the depreciation expense for Year 3.

What will be an ideal response?

a)

b) $9,250

You might also like to view...

The Rusties Market, a small antique shop, periodically runs advertisements in the local newspaper to keep its name before the public. This is known as ____ advertising.

A. primary-demand B. immediate-response C. reminder D. comparative E. public relations

During the most recent year, an estate generated income of $26,000: Rental income$11,700Interest income 7,800Dividend income 6,500?Prepare a schedule to show the amount of federal income tax that must be paid.

What will be an ideal response?

When a person with a record of physical impairment is also contagious, is that person removed from coverage under Section 504?

Single-row functions return one row of results for each group or category of rows processed. _________________________

Indicate whether the statement is true or false