In Fuel Injection Products & Service Corporation's suit against Gears & Cylinders, Inc, the jury re¬turns a verdict in Fuel Injection's favor. Gears & Cylindersfiles a motion asking the judge to set aside the verdict and begin new proceedings. This is a mo¬tion for

a. a judgment in accordance with the verdict.

b. a judgment on the pleadings.

c. a new trial.

d. judgment n.o.v.

C

You might also like to view...

Suppose the estimated regression line for predicting the high temperature of the day from the nighttime low temperature is y = 12 + 1.2x. What is the value for the residual when the nighttime low is 45 if the observed daytime high temperature is 70?

a .-4 b. 4 c. 66 d. 25

Anyone who violates an author's exclusive rights under a copyright is liable for

a. a prison term. b. actual damages only. c. actual damages plus any profits from use. d. any profits from use but not damages.

A T-account has a $2,110 credit balance. This account is most likely:

A) an expense. B) a dividend account. C) an asset. D) a stock account.

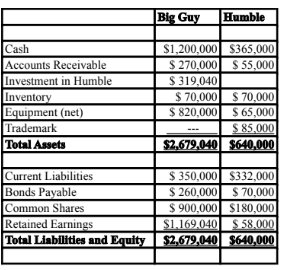

The amount of Common Shares appearing on Big Guy's consolidated balance sheet on June 30, 2020 would be:

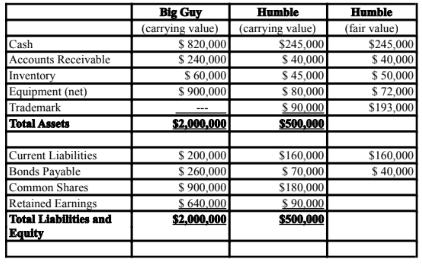

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2017. On that date, Humble Corp. had Common Shares and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2027. Both companies use straight line amortization, and no salvage value is assumed

for assets. The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment. The balance sheets of both companies, as well as Humble's fair market values on the date of acquisition are disclosed below:

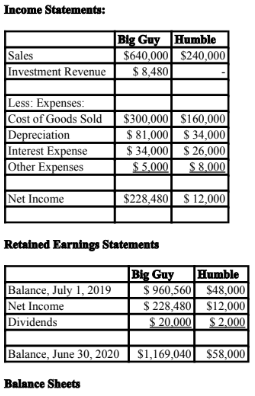

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2020:

An impairment test conducted in September 2018 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2020, Humble Inc. borrowed $20,000 in cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in

Humble Corp. Assume that the entity method applies.

A) $1,080,000. B) $1,044,000. C) $900,000. D) $1,800,000.