Answer the following statement(s) true (T) or false (F)

7. The income statement is a report that measures the financial performance of your business on an annual or monthly basis.

8. An introductory offer is a form of high pricing, generally used for new products or services that face very little or even no competition.

9. In an income statement, taxes are the last expense item before net income.

10. Regardless of the type of business, all businesses need to generate revenue.

11. The operating profit represents the amount left over from revenue once all costs and operating expenses are subtracted

7. True

8. False

9. True

10. True

11. True

You might also like to view...

Most appropriations of retained earnings are not for:

a. contract restrictions. b. management decisions. c. restriction by law. d. dividends.

The sales volume variance is the difference between the ________

A) actual results and the expected results in the flexible budget for the actual units sold B) expected results in the flexible budget for the actual units sold and the static budget C) static budget and actual amounts due to differences in sales price D) flexible budget and static budget due to differences in fixed costs

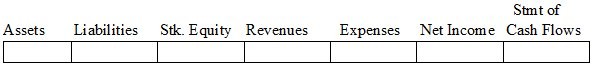

Use the following to answer questions 1?9:Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter dollar amounts. (Note that "Not Affected" means that the event does not affect that element of the financial statements or the event causes an increase in that element that is offset by a decrease in the same element.)Increase = IDecrease = DNot Affected = NAIn preparing the bank reconciliation for Heath Company, an employee found that a certified check that the company had used to settle an account payable remained outstanding.

What will be an ideal response?

Title 26 of the U.S. Code includes

A) income tax legislation only. B) gift tax and estate tax legislation only. C) alcohol and tobacco tax legislation only. D) all of the tax legislation mentioned above.