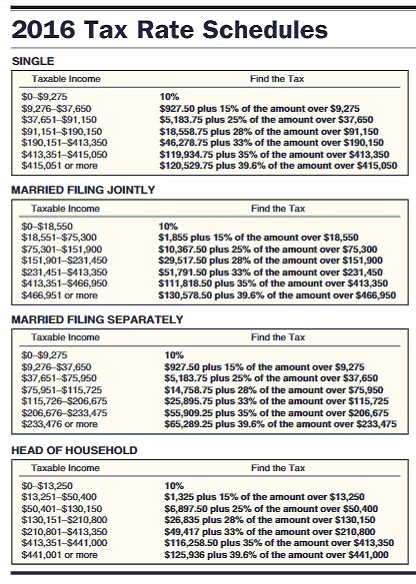

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 formarried taxpayers filing separately, and $9300 for head of household and the tax rate schedule. Jennifer Binh is single and claims one exemption. Her salary last year was $95,949, and she had other income of $5,852 and interest income of $8,110. She has adjustment to income of $2,218 for an IRA contribution. Her itemized deductions are $4,996 in mortgage interest, $2,376 in state income tax, $1,642 in real estate taxes, and $782 in charitable contributions.

Jennifer Binh is single and claims one exemption. Her salary last year was $95,949, and she had other income of $5,852 and interest income of $8,110. She has adjustment to income of $2,218 for an IRA contribution. Her itemized deductions are $4,996 in mortgage interest, $2,376 in state income tax, $1,642 in real estate taxes, and $782 in charitable contributions.

A. $2,967.16

B. $19,313.91

C. $19,674.25

D. $21,111.04

Answer: B

You might also like to view...

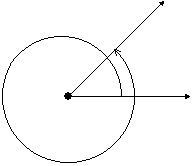

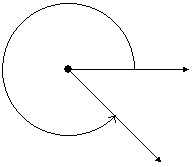

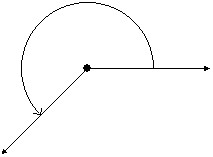

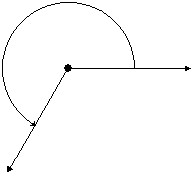

Draw the angle in standard position.

A.

B.

C.

D.

Determine the amplitude or period as requested.Period of y = 5 cos (6?x + 3?)

A. 6?

B.

C.

D. 3

Determine the area or volume as indicated. Use 3.14 for ? when necessary. Find the volume.

Find the volume.

A. 439.6 ft3 B. 3077.2 ft3 C. 769.3 ft3 D. 219.8 ft3

Solve.Anita is interested in the relationship between age and salary for the employees of her company. She obtains the following information which shows the average annual income for employees of various ages.  a.Draw a scatter diagram of the data treating age as the independent variable.b. What type of relation appears to exist between age and average income?c. Find an equation of the line containing the points (36, 41.9) and (59, 65.5).d. Graph the line on the scatter diagram.e. Predict the income of an employee aged 37.f. Interpret the slope of the line.

a.Draw a scatter diagram of the data treating age as the independent variable.b. What type of relation appears to exist between age and average income?c. Find an equation of the line containing the points (36, 41.9) and (59, 65.5).d. Graph the line on the scatter diagram.e. Predict the income of an employee aged 37.f. Interpret the slope of the line.

What will be an ideal response?