There are many types of taxes

What will be an ideal response?

depending on the tax, the revenues accrue to different governmental institutions. Some examples:

Income tax - funds go to the federal government

Sales tax - funds go to the state government

Property tax - funds go to city or town and primarily used for funding education

You might also like to view...

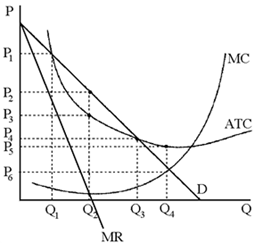

Figure 11-6

A. P1. B. P2. C. P3. D. P4.

Costumarily, economists classify resources in to these major groups:

What will be an ideal response?

Which of the following is true?

A. If high inflation and sluggish growth have the same cause, they will show up in the economic data at the same time. B. Sluggish growth may show up in economic data before high inflation, even if the two have the same cause. C. High inflation may show up in economic data before sluggish growth, even if the two have the same cause. D. If high inflation and sluggish growth have different causes, they cannot show up in the economic data at the same time.

Perfectly competitive firms cannot individually affect market price because

A. Demand is perfectly inelastic for their goods. B. There are many firms, none of which has a significant share of total output. C. The government exercises control over the market power of competitive firms. D. There is an infinite demand for their goods.