The incentive to consume tax-deductible goods, instead of nondeductible goods, increases when

a. marginal tax rates are high.

b. marginal tax rates are low.

c. the inflation rate is low and relatively stable.

d. This is a trick question: the consumption of tax-deductible goods is not affected by marginal tax rates.

A

You might also like to view...

The oldest central bank, having been founded in 1694, is the

A) Bank of England. B) Deutsche Bundesbank. C) Bank of Japan. D) Federal Reserve System.

When economic growth (a gradual shift of LRAS to the right) expands the production possibilities of an economy,

a. a higher rate of real output can be achieved in the short run, but it cannot be sustained in the long run. b. a larger output can be attained even if unemployment remains at its natural rate. c. the general level of prices will rise if the money supply is held constant. d. the equilibrium in the goods and services market will be disrupted.

Suppose one U.S. dollar can purchase a half pound of strawberries in the United States. After converting dollar to pesos, one U.S. dollar can now purchase a full pound of strawberries in Mexico. These values represent:

a) a real exchange rate. b) a nominal exchange rate. c) a purchasing power parity rate. d) a transaction rate.

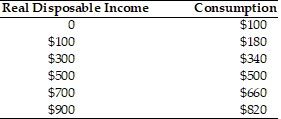

In the above table, saving is positive when real disposable income is greater than

In the above table, saving is positive when real disposable income is greater than

A. $100. B. $300. C. $500. D. zero.