Find the Social Security tax (6.2%), Medicare tax (1.45%), and state disability insurance deduction (1%) for the employee. Assume the employee is under the FICA and SDI maximums at the end of the current pay period and assume that  is paid for any overtime in a

is paid for any overtime in a  week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxNeely, P. 42.1 $13.50

week. Round to the nearest cent if needed. Hours Reg FICA Medicare SDIEmployee Worked Rate Tax Tax TaxNeely, P. 42.1 $13.50

A. $33.48, $7.83, $5.40

B. $36.12, $8.45, $5.83

C. $52.86, $12.36, $8.53

D. $35.24, $8.24, $5.68

Answer: B

You might also like to view...

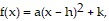

Solve the problem.The table lists numbers of bachelor's degrees awarded by a midwestern college in selected years. Determine  so that f models these data.

so that f models these data.

A. f(x) = 2(x - 2002)2 + 468 B. f(x) = 1.8(x - 2002)2 + 468 C. f(x) = 1.8(x - 1992)2 + 648 D. f(x) = 2(x - 1992)2 + 648

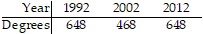

Use the graph to complete the identity.cos 3x cos 5x + sin 3x sin 5x = ?

A. y = sin 2x B. y = cos 2x C. y = cos 8x D. y = sin 8x

Solve the problem.A teacher designs a test so a student who studies will pass 93% of the time, but a student who does not study will pass 7% of the time. A certain student studies for 93% of the tests taken. On a given test, what is the probability that student passes?

A. 0.049 B. 0.87 C. 0.865 D. 0.5

Use the Binomial Theorem to find the indicated coefficient or term.The coefficient of  in the expansion of

in the expansion of  3

3

A. 9 B. 3 C. 6 D. 2