Assume that the expectation of declining housing prices cause households to reduce their demand for new houses and the financing that accompanies it. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and real GDP in the context of the Three-Sector-Model?

a. The real risk-free interest rate falls, and real GDP rises.

b. The real risk-free interest rate and real GDP remain the same.

c. The real risk-free interest rate rises, and real GDP falls.

d. The real risk-free interest rate falls, and real GDP remains the same.

e. The real risk-free interest rate falls, and real GDP falls.

.E

You might also like to view...

Investment is equal to all purchases of newly produced capital goods

A) minus changes in business inventories. B) plus fixed investment minus inventory investment. C) plus changes in business inventories. D) plus changes in business inventories plus purchases of new residential housing.

Under a fixed exchange rate regime, what will happen to the balance of payments for the United States and Mexico when the demand for Mexican goods rises? What is the only possible solution to this problem, given the fixed exchange rate?

What will be an ideal response?

Explain the difference between minimum wage and subsidies as a way to help low-income people. Identify disadvantages of each.

What will be an ideal response?

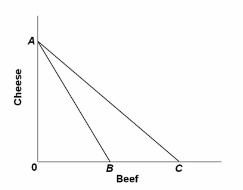

Refer to the given diagram in which line AB is the U.S. production possibilities curve and AC is its trading possibilities curve. The international exchange ratio between beef and cheese (terms of trade):

A. is the absolute value of the slope of line AB.

B. is the absolute value of the slope of line AC.

C. could lie anywhere between the absolute value of the slopes of lines AB and AC.

D. cannot be determined on the basis of this information.