Assume that the expectation of a recession next year causes business investments and household consumption to fall, as well as the financing to support it. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the GDP Price Index and reserves account in the context of the Three-Sector-Model?

a. The GDP Price Index falls and reserves

account becomes more negative (or less positive).

b. The GDP Price Index falls and reserves account remains the same.

c. The GDP Price Index and reserves account remain the same.

d. The GDP Price Index rises and reserves account remains the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

Dividends are the interest rates paid on stocks

Indicate whether the statement is true or false

The nominal deficit depends primarily on:

A. the debt. B. the rate of inflation. C. government's expenditures and receipts. D. the difference between potential and actual output.

Why might the supply of loans increase as interest rates fall?

What will be an ideal response?

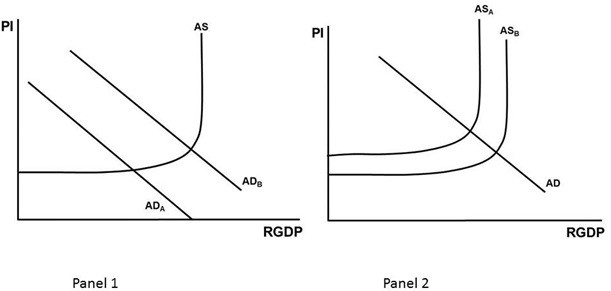

Using Figure 48.1, modeling the attacks of September 11, 2001, you would show the aggregate demand shock by using  Figure 48.1

Figure 48.1

A. Panel 2 only with a shift from ASA to ASB. B. Panel 1 only with a shift from ADB to ADA. C. Panel 1 only with a shift from ADA to ADB. D. Panel 1 to model the aggregate demand shock (ADB to ADA) and Panel 2 to model the aggregate supply shock (ASB to ASA).