In the United States during the 1930s, politicians:

A. relied on government spending and taxation to pull the economy out of the depression.

B. did not believe in using government spending and taxation because they feared the consequences of budget deficits.

C. knew that the depression would eventually subside because of automatic stabilizers.

D. deliberately relied on government spending and taxation even though they knew the depression would continue.

Answer: B

You might also like to view...

Property rights protect

A) only the rights to physical property. B) rights to physical property, financial property, and intellectual property. C) the government's right to impose taxes. D) only the rights to financial property. E) all rights except rights to intellectual property.

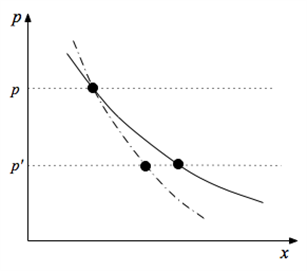

The following graph applies to a consumer for whom good x is an inferior good. The price of x falls from p to p', and one of the curves below represents the consumer's (uncompensated) demand curve while the other represents the consumer's compensated demand (or MWTP) curve.

c. Once the consumer has optimized at the new price p', illustrate the new (uncompensated) demand and the new MWTP curve. d. For curves that have shifted, explain why; for curves that have not shifted, explain why as well. What will be an ideal response?

Which of the following is explained by the price elasticity of demand for a product?

a. The effect of changes in price on the supply of the product b. The effect of changes in quantity on the supply of the product c. The effect of changes in quantity on the price of the product d. The effect of changes in price on the quantity demanded of the product e. The effect of changes in price on the quantity supplied of the product

If taxes were a lump-sum amount, then the magnitude of the government spending multiplier ________ it would be if taxes depend on income.

A. is equal to what B. is larger than C. is smaller than D. could be either larger than or smaller than