According to the Laffer curve, an increase in the tax rate will decrease tax revenue

A. if the economy is on the positively sloped section of the curve.

B. if the economy is on the negatively sloped section of the curve.

C. no matter the location of the economy on the curve.

D. if the economy is at the 0% tax rate point on the curve.

Answer: B

You might also like to view...

According to the AK growth model, taxes on corporate income and capital gains ________ the incentive for firms to accumulate capital and ________ the steady-state growth rate

A) increase; increase B) reduce; reduce C) increase; do not change D) reduce; do not change

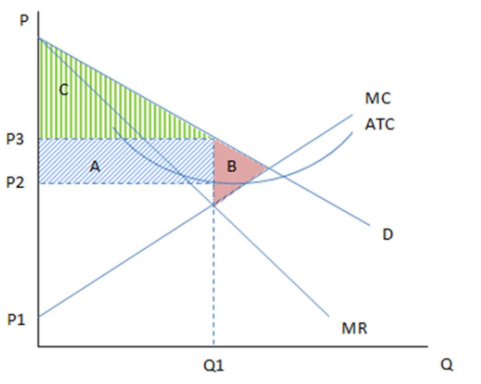

According to the graph shown, the monopolistically competitive firm will produce:

These are the cost and revenue curves associated with a monopolistically competitive firm.

A. where MR = MC and will charge according to ATC.

B. where MR = MC and will charge according to D.

C. where D = MC and will charge according to MR.

D. where D = MC and will charge according to ATC.

In the short run, if a firm's total variable cost curve lies everywhere above its total revenue curve, the firm should produce

a. the output level that minimizes average total cost b. the output level that minimizes average variable cost c. the output level that minimizes the distance between marginal cost and marginal revenue d. the output level that maximizes the distance between marginal cost and marginal revenue e. no output

The banking system is able to make new loans equal to

A) total legal reserves of the system. B) total excess reserves of the system. C) total required reserves of the system. D) a multiple of total excess reserves of the system.