Sarah and Andrew are two traders in a pure exchange economic with two goods, Bikes (B) and Computers (C). Sarah's preferences are described by the Cobb-Douglas Utility function:

US = BS1/3CS2/3

Andrew's preferences are given by:

UA = BA1/2CA1/2

Assume the price of Bikes is 1 and the price of computers is p. The initial endowments are BA = 10, BS = 20, CA = 20 and CS = 10. Solve for the competitive equilibrium prices (relative prices) and quantities.

Determine the demand equations using the incomes and preferences. Sarah's income is:

20 + 10p = YS

Her demand curves are:

BS = YS/3 = (20 + 10p)/3

CS = 2YS/3p = (40 + 20p)/3p

Andrew's income is:

10 + 20p = YA

His demand curves are:

BA = YA/2 = 5 + 10p

CA = YA/2p = (5 + 10p)/p

Setting supply (BA + BS = 30 ) equal to demand:

30 = (20 + 10p)/3 + 5 + 10p

Solving:

p = 55/40(Equating the supply and demand for computers yields the same result.)

You might also like to view...

In theory, any object ________ could play the role of fiat money

A) in unlimited supply B) for which demand is limited C) in limited supply D) that has an unlimited demand

According to the law of demand

A) people buy more of a good when the price rises. B) people buy more of a good when their income rises. C) people buy more of a good when the relative price rises. D) people buy more of a good when the price falls.

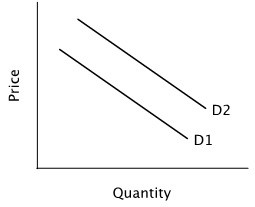

Refer to the accompanying figure. Moving from demand curve D2 to demand curve D1 could be caused by a(n):

A. increase in the price of a substitute. B. increase in the product's expected future price. C. increase in the price of a complement. D. increase in quantity supplied.

The expectations hypothesis cannot explain why:

A. short-term yields are more volatile than long term yields. B. yields on securities of different maturities move together. C. yield curves usually slope upward. D. long-term bonds usually are less liquid than short-term bonds with the same default risk.