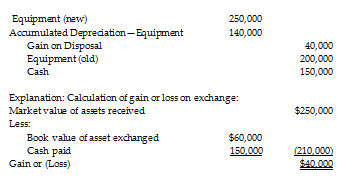

Dew Drops Company purchased equipment for $200,000. The company recorded total depreciation of $140,000. On January 1, 2018, the company exchanges the equipment for new equipment, paying $150,000 cash. The fair market value of the new equipment is $250,000. Prepare the journal entry to record this transaction. Assume the exchange has commercial substance. Omit explanation.

What will be an ideal response?

You might also like to view...

AMA stands for ______.

A. American Marketers Association B. American Marquee Association C. Anonymous Marketers Association D. American Marketing Association

________ consider proposed fixed-asset outlays, research and development activities, marketing and product development actions, capital structure, and major sources of financing

A) Short-term financial plans B) Long-term financial plans C) Pro forma statements D) Cash budgeting

On Monday, Travis took his four-wheeler to Reppart's Equipment & Service for repair because the steering was not working properly. On Friday he called Reppart's to see if his four-wheeler was ready because he wanted it for a weekend trip. Reppart's said

they had done the major repairs but that the steering system still needed some work and they needed another few days to finish the repairs. Travis told them he would pick the four-wheeler up and use it for the weekend and then bring it back to have them finish their work. While riding with friends on the weekend, Travis ran into someone because the steering stuck and he couldn't swerve to avoid them. Discuss how a court would determine causation in a negligence suit against Travis.

Which of the following conditions need to be satisfied by an employer in China before reducing his or her workforce by at least 20 employees or by 10 percent?

A) The employer is restructuring due to bankruptcy. B) The employer is experiencing difficulties in production and operations. C) A material (significant) change in the objective economic circumstances has occurred, making performance and fulfillment of the employee contract impossible. D) Any of the above.