The relationship between annual real per-capita GDP and corruption across countries has been found to be

A) negative.

B) positive.

C) The relationship was negative in the late 1960s but is now positive.

D) The relationship was in the late 1960s but is now negative.

E) There is no relationship between these two variables.

A

You might also like to view...

What is the accelerator theory of investment spending?

What will be an ideal response?

Gross investment equals net investment plus

A) capital. B) capital gains. C) depreciation. D) dividends paid to the owners of the company.

Financial crises generally develop along two basic paths

A) mismanagement of financial liberalization/globalization and severe fiscal imbalances. B) stock market declines and severe fiscal imbalances. C) mismanagement of financial liberalization/globalization and stock market declines. D) stock market declines and unanticipated declines in the value of the domestic currency.

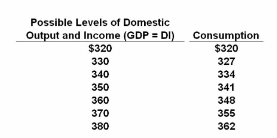

Refer to the data for a private closed economy. If gross investment is $12 billion, the equilibrium level of GDP will be:

A. $380.

B. $370.

C. $360.

D. $350.