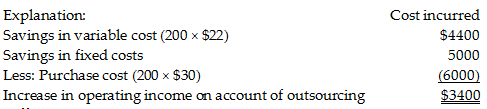

A company produces 200 microwave ovens per month, each of which includes one electrical circuit. The company currently manufactures the circuits in-house but is considering outsourcing the circuits at a contract cost of $30 each. Currently, the cost of producing circuits in-house includes variable costs of $22 per circuit and fixed costs of $5000 per month. Assume the company could eliminate all fixed costs by outsourcing and that there is no alternative use for the facilities presently being used to make circuits. If the company outsources, operating income will ________.

A) increase by $1600

B) decrease by $6000

C) decrease by $1600

D) increase by $3400

D) increase by $3400

You might also like to view...

According to Carl Rogers (1967) our environment should provide three basic conditions to enable self-growth. Which of the following is NOT one of those?

a. People must be authentic about their feelings b. People must be accepting of oneself and others – even of failures and shortcomings c. People must practice empathy d. People must believe in and practice their religion

List and describe Peter Frost’s Seven Deadly INs. Using your own experiences, provide some practical examples of each of the Ins and how they affect teams. Using your knowledge gained in the subject, provide some advice on how the INs can be managed in teams.

What will be an ideal response?

Answer the following statement(s) true (T) or false (F)

1. External setups do not require the retraining of employees. 2. In determining the correct number of Kanban containers, a relevant consideration is the cost of storage of the finished product. 3. Reducing sustainability is the result of reducing inventory and its locations. 4. The cost of services that are delivered is a factor that makes it easier to implement lean in a service delivery system. 5. One of the principles a service operation should follow to create a lean system is to design the process to meet customer requirements.

Dan sold 135 shares (assume 100 are long-term) of Elite Mutual Fund on July 26, 2018 for $95 per share and received a 1099-B (box 3 was not checked for basis) to record the sale of the shares. Dan's investment portfolio includes the following purchases of Elite Mutual Fund: May 20, 2015 50 shares at $100 per shareMarch 29, 2016 50 shares at $95 per shareAugust 21, 2017 50 shares at $85 per shareFebruary 22, 2018 100 shares at $75 per shareIn 2018, Dan will recognize:

A. no long-term gain or loss and a $333.45 short-term gain. B. $250 long-term loss and $583.45 short-term gain. C. no short-term gain or loss and a $1,215 long-term gain. D. $315 short-term gain and a $900 long-term gain.