Describe and explain the three principle methods of financing used by corporations

What will be an ideal response?

Corporations raise funds by selling stocks, selling bonds, and reinvesting profits. A share of stock is a form of ownership in the firm and entitles the owner to a share of future profits. A person who buys a bond from a firm is lending the firm money. Finally, if the firm earns profits, it can use some of them for investment rather than pay them all out to stockholders as dividends.

You might also like to view...

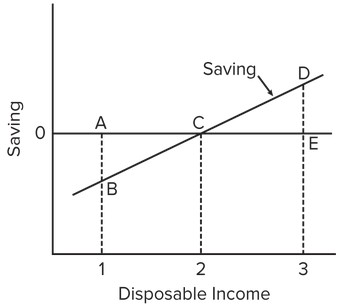

Use the following saving schedule to answer the next question.  As income falls from level 3 to level 2, the amount of

As income falls from level 3 to level 2, the amount of

A. dissaving increases. B. saving increases. C. dissaving decreases. D. saving decreases.

Refer to Figure 12-5. If the market price is $20, what is the firm's profit-maximizing output?

A) 750 units B) 1,100 units C) 1,350 units D) 1,800 units

The Phillips curve represents a direct relationship between the inflation rate and the unemployment rate

a. True b. False Indicate whether the statement is true or false

The Clayton Act of 1914:

A. prohibited selling products at "unreasonably low prices" with the intent of reducing competition. B. made it illegal to monopolize a market. C. repealed the Sherman Act. D. outlawed price discrimination for the purpose of reducing competition.