How might asymmetric information cause a well-managed bank to be abandoned by its depositors?

What will be an ideal response?

Bank depositors know little about their bank's lending practices, except when a particular bank fails. Depositor's at other banks have to wonder whether their bank is safe, which comes down to whether other depositors believe the bank to be safe. In the absence of credible deposit insurance, any depositor who is unsure that other depositors will keep their funds in the bank must, rationally, withdraw her funds. If enough depositors do so, the bank has failed.

You might also like to view...

Refer to Scenario 14.1. Lisette's dominant strategy will give her a net benefit of

A) $45. B) $75. C) $120. D) $150.

Arrow suggests that any social choice process should be applicable to any set of preferences for individuals -- because we can't be sure individual preferences are always rational.

Answer the following statement true (T) or false (F)

In the Cournot model

A) market price is unaffected by the actions of any individual firm. B) firms do not have to worry about the strategies of the other firms. C) firms' profits are independent. D) firms' profits are interdependent.

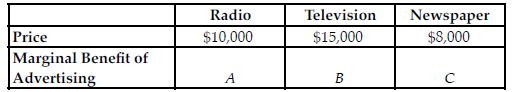

Refer to the table below. If at the current advertising level, A = $9,800, B = $15,000, and C = $8,200, to maximize profit, which of the following should the firm do?

The table above shows the current costs for a firm to advertising on the radio, television, and newspaper.

A) The firm should decrease its advertising on the television and increase its advertising in newspapers.

B) The firm should decrease its advertising on the radio and increase its advertising in newspapers.

C) The firm should decrease its advertising on the radio and decrease its advertising in newspapers.

D) The firm should increase its advertising on the television and decrease its advertising in newspapers.