How do high interest rates increase the risk of adverse selection in the bond market?

What will be an ideal response?

Investors often reason that as interest rates on bonds rise, a larger fraction of the firms willing to pay the high interest rates are lemon firms. After all, the managers of a firm facing bankruptcy may well be willing to pay very high interest rates to borrow funds that can be used to finance risky investments.

You might also like to view...

Suppose that the government enacts a tax on Good X. In order to estimate the effect of the tax on the quantity demanded of a related good, Good Y, we can use the concept of the:

A) price elasticity of demand. B) income elasticity of demand. C) cross-price elasticity of demand. D) cost elasticity of demand.

A major U.S. motive for negotiating a free-trade agreement with Mexico was to

a. help foster the study of the Spanish language as a means to trading with all Spanish-speaking countries b. increase immigration into the United States c. gain increased access to Mexican consumers d. keep Mexico from going Communist e. achieve, ultimately, political union with Mexico

Evidence suggests that mergers and increased profitability do not necessarily go hand in hand

Indicate whether the statement is true or false

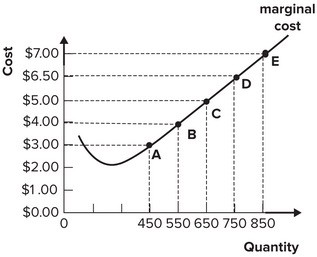

Refer to the graph shown. If market price is currently $3.00 per unit, this perfectly competitive firm will maximize profit by producing:

A. 850 units of output. B. 650 units of output. C. between 550 and 650 units of output. D. 450 units of output.