What price would an individual would be willing to pay for a stock that currently pays a $5.00 annual dividend if the individual expects the dividend to grow by 4% (0.04) per year and the individual has a discount rate of 6.0% (0.06)?

What will be an ideal response?

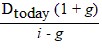

We can calculate the Ptoday by using equation 8 from the chapter: The equation,

Ptoday =

where i is the discount rate, or in this case 0.06; g is the growth rate of the dividend, or in this case 0.04; and the Dtoday is the current dividend of $5.00. Inserting these values into the equation we solve for Ptoday and obtain $260.00

You might also like to view...

Suppose milk and cereal are compliments and the demand for milk is Qdm = 40 - 6Pm - 2Pc, where Qdm stands for millions of gallons of milk demanded, Pm stands for the price of milk and Pc stands for the price of cereal. The supply of milk is Qsm = 6Pm - 8, where Qsm stands for millions of gallons of milk supplied. The demand and supply of cereal are Qdc = 90 - 5Pc - Pm and Qsc = 5Pc - 10, respectively, where Qdc stands for millions of boxes of cereal demanded and Qsc stands for millions of boxes of cereal supplied. Suppose the government imposes a $2.00 per gallon tax on milk. The new general equilibrium price of milk is:

A. $2.37. B. $4.37. C. $0.37. D. $3.39.

Purchasing power parity explains how the exchange rate will adjust to differences in price levels between two countries

a. True b. False Indicate whether the statement is true or false

A firm's demand curve for labor coincides with the:

A. marginal cost curve. B. average cost curve. C. marginal revenue curve. D. marginal revenue product curve.

If the quantity demanded for good A increases from 40 to 60 when price decreases from $9 to $7, price elasticity of demand in this price range is 1.6.

Answer the following statement true (T) or false (F)