A 12-year bond has an annual coupon of 9%. The coupon rate will remain fixed until the bond matures. The bond has a yield to maturity of 7%. Which of the following statements is CORRECT?

A. If market interest rates decline, the price of the bond will also decline.

B. The bond is currently selling at a price below its par value.

C. If market interest rates remain unchanged, the bond's price one year from now will be lower than it is today.

D. The bond should currently be selling at its par value.

E. If market interest rates remain unchanged, the bond's price one year from now will be higher than it is today.

Answer: C

You might also like to view...

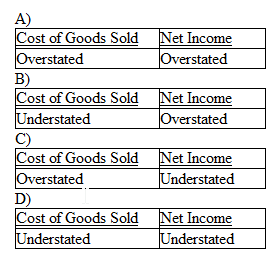

Ending inventory for the current accounting period is overstated by $2,700. What effect will this error have on Cost of Goods Sold and Net Income for the current accounting period?

Aggie, Inc Aggie, Inc purchased a truck at a cost of $12,000. The truck has an estimated salvage value of $2,000 and an estimated life of 5 years, or 100,000 hours of operation. The truck was purchased on January 1, 2011, and was used 27,000 hours in 2011 and 26,000 hours in 2012. Refer to Aggie, Inc's information presented above, if Aggie uses the straight-line method, what is the book value at

December 31, 2013? A) $ 8,000 B) $ 6,000 C) $10,000 D) $ 4,000

Hindrance stressors are

a. Positively related to motivation and performance b. Positively related to ambition and inefficiency c. Negatively related to motivation and performance d. Negatively related to ambition and inefficiency

Using IM allows you to avoid the hassle of following grammar and punctuation standards

Indicate whether the statement is true or false