Joanne left her last job, in which she was earning $50,000, in order to form her own consulting business. Her revenues for the first year of consulting were $200,000

During that year, she hired two assistants for $25,000 each and spent $25,000 on office equipment. In addition, she incurred $75,000 in miscellaneous expenses. Her economic profit that first year was A) $0.

B) $50,000.

C) $200,000.

D) $75,000.

A

You might also like to view...

What is the principle of minimum differentiation?

What will be an ideal response?

This year, on advice from your sister, you bought tobacco company stock at $50/share. During the year, you collected an $8 dividend, but due to the company's losses in medical lawsuits its stock fell to $40/share

At this point, you sell, realizing a A) dividend yield of -16% and a capital loss of 20%. B) dividend yield of 16% and a capital loss of 20%. C) dividend loss 10%. D) capital loss of 10%. E) total loss of 20%.

In the problem of double marginalization, the resulting price is ______than if the manufacturer and the retailer were to merge

a. Higher b. Lower c. The same d. None of the above

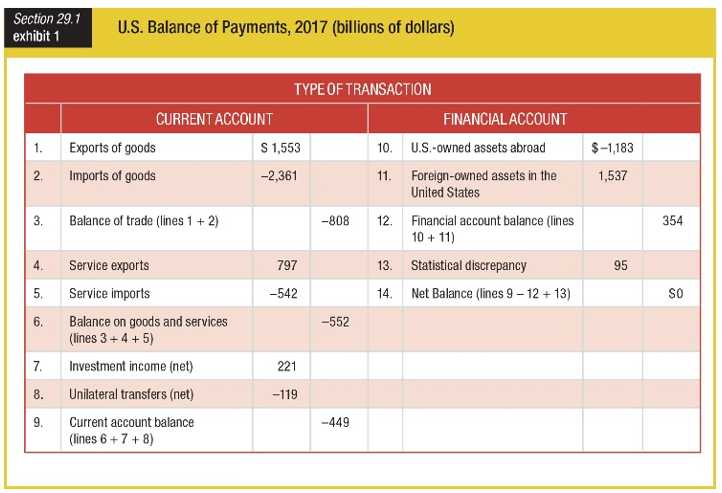

What was the total of U.S.-owned assets abroad in 2017?

a. -$1,183 billion

b. -$552 billion

c. $221 billion

d. $1,537 billion